Financial system Sweet’s cabinets brim with sweets from world wide – gummies from Germany, lollipops from Spain, sweets from Japan and a panoply of candies from throughout the U.S.

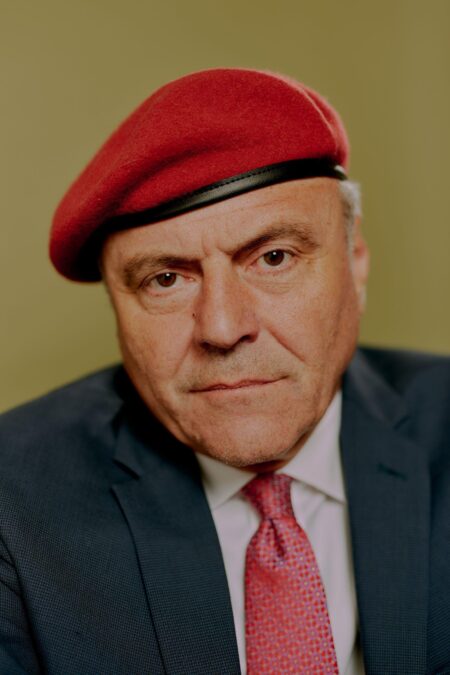

Standing amid all of it, columns of vivid jellybeans to his left and unique Package Kats to his proper, proprietor Mitchell Cohen is fast along with his evaluation of what number of of this store’s 2,000-plus gadgets are affected by the historic spherical of tariffs introduced by President Donald Trump.

“I think all of them,” Cohen says at his retailer on New York’s Decrease East Aspect.

Few corners of the American economic system are untouched, instantly or not directly, by the sweeping tariffs being imposed by Trump. Even just a little retailer like Financial system Sweet.

Cohen had simply begun to really feel a barrage of inflation-driven value will increase from suppliers ease when the tariff threats arrived. For a enterprise with a reputation like Financial system Sweet, he needs to stay inexpensive however fears how excessive some costs might need to climb within the coming months.

“I think it’s gonna be another round of this hyperinflation on some items,” says 39-year-old Cohen. “If we’re putting tariffs everywhere, it is going to go up.”

AP

AP

Consumers go to Financial system Sweet in New York’s Decrease East Aspect, Friday, April 4, 2025. (AP Photograph/Richard Drew)

Entering into Financial system Sweet looks like a time warp. Its title is emblazoned on an indication in a classic, blaring purple script, and crossing beneath its green-and-white striped awning, previous the bins of Smarties, butterscotches and Lemonheads within the entrance window, an indecipherable sweetness fills the air, oldies music sounds overhead and prospects mill round stacks of sweet bars they forgot nonetheless existed.

It represents only a blip within the nation’s $54 billion sweet business. But it surely was already feeling the load of surges in costs of cocoa and different elements earlier than tariffs have been layered on.

Sweet and gum costs are up about 34% from 5 years in the past and 89% from 2005, in accordance with Client Value Index information. Value, in accordance with the Nationwide Confectioners Affiliation, has turn out to be the highest think about customers’ sweet buy selections, outweighing a purchaser’s temper.

A few third of Financial system Sweet’s merchandise are imported, crowded on cabinets and tables close to the shop’s rear. There aren’t simply “more German Haribo varieties than the Haribo store in Germany,” as Cohen claims, however gummies the model makes in France, Austria and Britain.

They’ve each Milka bar they will discover in Switzerland, each sort of Leone onerous candies that Italy churns out and as many unique Package Kats from Japan as they will match.

On merchandise like these, the tariffs’ toll is clear.

Pistachio Snickers bars are from India, now topic to 26% tariffs, whereas ardour fruit mousse Snickers are from Portugal, now underneath the 20% European Union levies.

However even an American-made Snickers isn’t immune.

Whereas the bars might roll off conveyors in Texas, they depend on elements from across the globe. Sourcemap, which tracks provide chains, says Snickers bars are made with chocolate from Guyana, peanuts from Argentina and sugar from Brazil, wrapped up in packaging from Canada. All are actually subjected to various ranges of tariffs.

“There’s a lot of ingredients in there that have to come from other countries,” says Andreas Waldkirch, an economics professor at Colby School who teaches a category on worldwide commerce. “Unless you’re talking about something very simple from your local farmers market, almost every product relies on ingredients from elsewhere. Those indirect costs are really what’s going to drive up prices.”

The story repeats with American candies throughout the shop – the bins of Nerds and luggage of Sugar Infants and rolls of Smarties are all inextricably tied to the worldwide provide chain.

A desk teeming with these home delicacies takes heart stage close to Financial system Sweet’s entrance. Cohen took over the shop from his dad and mom, who took it over from their dad and mom earlier than. He received his first haircut within the retailer. He was behind the register as a baby. He took his spouse by on their first date.

As a child, every thing on the shop’s centerpiece desk of American treats value 59 cents. By 2020, the value was $1.29, however prospects who purchased a complete field paid a reduced price of $1 per piece.

Now, Cohen can’t even get them wholesale at that value.

Immediately, he sells the gadgets on the desk for $1.59. Cohen calls the choice a “loss leader” however thinks it is necessary to showcase his retailer’s affordability. As soon as the tariffs are totally applied, he’s undecided he’ll be capable to postpone value will increase.

“When your margins are coming down and your dollar doesn’t go as far at the end of the day, you really start to feel it,” he says. “But I don’t want anyone to come into Economy Candy and not think that it’s economical.”

The largest-ticket implications of the tariff blitz understandably acquire essentially the most consideration – the hundreds of {dollars} a automotive’s price ticket might develop, the tens of hundreds that disappear from a retirement account in a single day. However right here among the many root beer barrels and licorice strands, you are reminded that small-dollar gadgets are affected too, and so are the households promoting them.

At its beginning, the enterprise Cohen’s grandfather began centered on shoe and hat repairs. However within the wake of the Nice Despair, when few in a neighborhood of crowded tenements had cash for such fixes, the enterprise pivoted.

Sweet, as soon as relegated to a cart out entrance, took over the shop.

Within the 88 years since, enterprise hasn’t all the time been Chuckles and Zagnuts. The Sept. 11 assaults saved vacationers away and had gross sales sagging and the pandemic closed the shop and compelled it to pivot to on-line gross sales.

If tariffs upend issues, Cohen isn’t positive how he may adapt once more. He sells merchandise that aren’t made in America and he sells American merchandise made with elements from throughout the globe. He had simply been making headway on starting worldwide gross sales, however the net of tariff guidelines might make it not possible.

The common U.S. tariff may rise to just about 25% if the import taxes Trump placed on items from dozens of nations are totally applied Wednesday. That may be the best price in additional than a century, together with tariffs extensively blamed for worsening the Nice Despair.

Cohen is not positive how that may be true for a enterprise like his.

“I can understand bringing manufacturing and bringing things back to America, but you know, we rely on raw materials that just aren’t native to our country,” he says. “And it’s not like I can get a green tea Japanese Kit Kat from an American company.”

Cohen wore a smile anyway. He needs this to be a contented place for guests.

“You travel back to a time when nothing mattered,” Cohen says, “once you didn’t fear about something.”