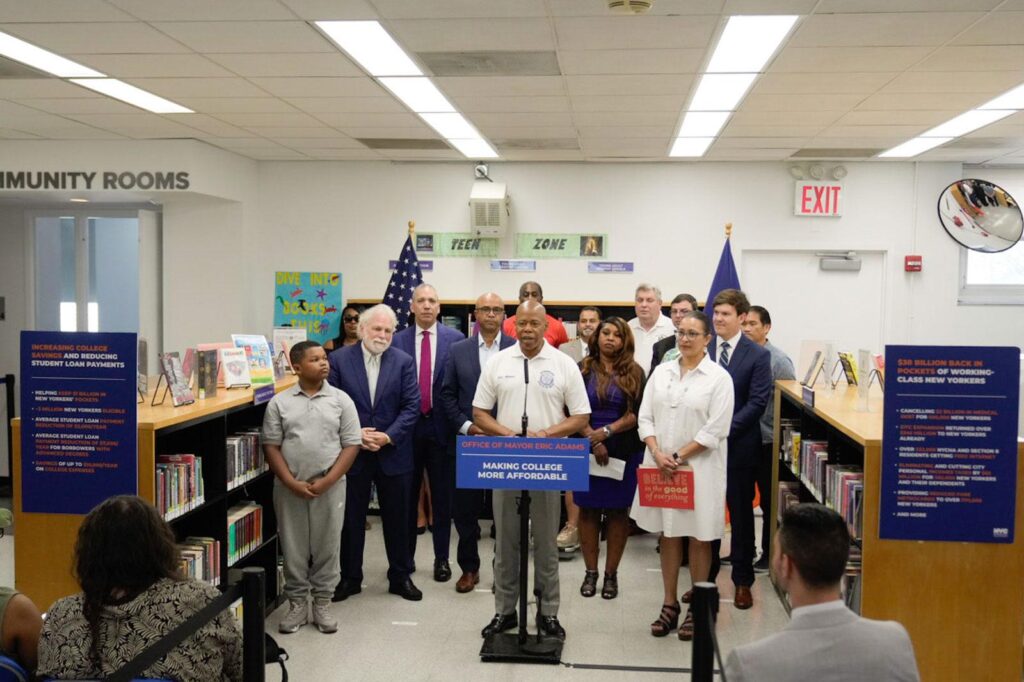

New York City’s Trailblazing Municipal Student Loan and College Support Program: A New Era in Education Financing

Revolutionizing Student Debt Relief for New Yorkers Through Municipal Innovation

In a bold move to ease the financial strain on its residents, New York City has introduced the nation’s inaugural Municipal Student Loan and College Assistance Program. This forward-thinking initiative is designed to save New Yorkers an estimated $1 billion by offering affordable loan refinancing and extensive support services directly through city administration. By harnessing the city’s collective bargaining power, the program aims to lower interest rates on existing student loans, making higher education more attainable and reducing the overwhelming debt burden that impacts thousands of families across the metropolis.

The program’s core benefits include:

- Stable, low fixed interest rates: Ensuring predictable repayment amounts throughout the loan term

- Customized repayment options: Designed to fit diverse income levels and employment situations

- Comprehensive educational support: Including grants and expert counseling for city-employed students

These features collectively aim to alleviate financial pressure, enabling New Yorkers to invest confidently in their education and future. Early participation rates reflect strong community interest, highlighting the demand for innovative financial solutions that promote economic well-being and academic success.

Understanding the Framework of the Nation’s First Municipal College Assistance Program

This pioneering program represents a municipal-level response to the escalating student debt crisis. Eligibility is carefully structured around residency and income criteria to prioritize aid for those most in need. Participants benefit from significantly reduced interest rates and flexible repayment plans tailored to their unique financial situations. Additionally, the initiative integrates financial literacy resources, empowering borrowers with the skills and knowledge necessary to manage their debt effectively and sustainably.

Program highlights include:

- Consolidation of multiple student loans into a single, manageable municipal loan

- Access to some of the lowest subsidized interest rates available nationwide

- Graduated repayment schedules that adjust based on income fluctuations

- Financial education workshops and personalized counseling services

| Feature | Advantage | Who Qualifies |

|---|---|---|

| Loan Consolidation | Streamlined payments with lower interest | City residents with existing student debt |

| Income-Based Repayment | Flexible monthly payments aligned with earnings | Applicants within specified income brackets |

| Financial Counseling | Guidance on debt management and budgeting | All enrolled participants |

Combating the Student Debt Epidemic with Localized, Data-Driven Solutions

New York City’s program addresses the student debt crisis by deploying targeted, community-focused strategies that deliver tangible relief. Utilizing local data and resources, the initiative offers tailored refinancing options, personalized financial coaching, and grants aimed at supporting the city’s diverse student body. These efforts not only reduce debt loads but also promote financial literacy and long-term economic resilience among residents. As the first program of its kind, it serves as a blueprint for other urban centers facing similar challenges.

Key elements of this approach include:

- Refinancing with low-interest rates customized to individual income and career trajectories

- Grants for college expenses to minimize reliance on loans

- Community-based workshops offering practical advice on budgeting and repayment

- Collaborations with academic institutions to analyze program effectiveness and guide improvements

| Program Component | Anticipated Impact | Implementation Timeline |

|---|---|---|

| Loan Refinancing | Cut interest expenses by approximately 15% | First two years |

| College Grants | Assist over 5,000 students annually | Ongoing |

| Financial Literacy Workshops | Engage more than 10,000 participants in year one | Year one |

Strategic Policy Recommendations to Enhance Reach and Effectiveness

To maximize the program’s impact, policymakers should emphasize scalability and inclusivity. Expanding eligibility to include part-time students, vocational learners, and other nontraditional candidates will ensure a fairer distribution of benefits. Embedding financial education and personalized counseling within the program framework will empower participants to make informed decisions, reducing default rates and promoting sustainable repayment.

Priority policy actions include:

- Boosting collaboration between state and local governments to secure ongoing funding

- Deploying targeted outreach to underserved and marginalized communities

- Enhancing transparency through robust data collection and public reporting

- Fostering partnerships with private lenders to supplement municipal resources

| Policy Area | Expected Benefit |

|---|---|

| Expanded Eligibility | Greater access for diverse student populations |

| Financial Literacy Integration | Improved repayment rates and reduced defaults |

| Public-Private Partnerships | Increased funding and resource availability |

| Data Transparency | Ongoing program refinement and accountability |

Conclusion: Paving the Way for Affordable Higher Education in Urban America

As New York City embarks on this unprecedented Municipal Student Loan and College Assistance Program, it sets a transformative precedent in the fight against student debt. By prioritizing accessible, affordable financing and comprehensive support, the city not only empowers its residents to achieve their educational goals but also offers a replicable model for other municipalities nationwide. With sustained commitment and community engagement, this initiative has the potential to redefine higher education affordability and economic opportunity for generations of New Yorkers.