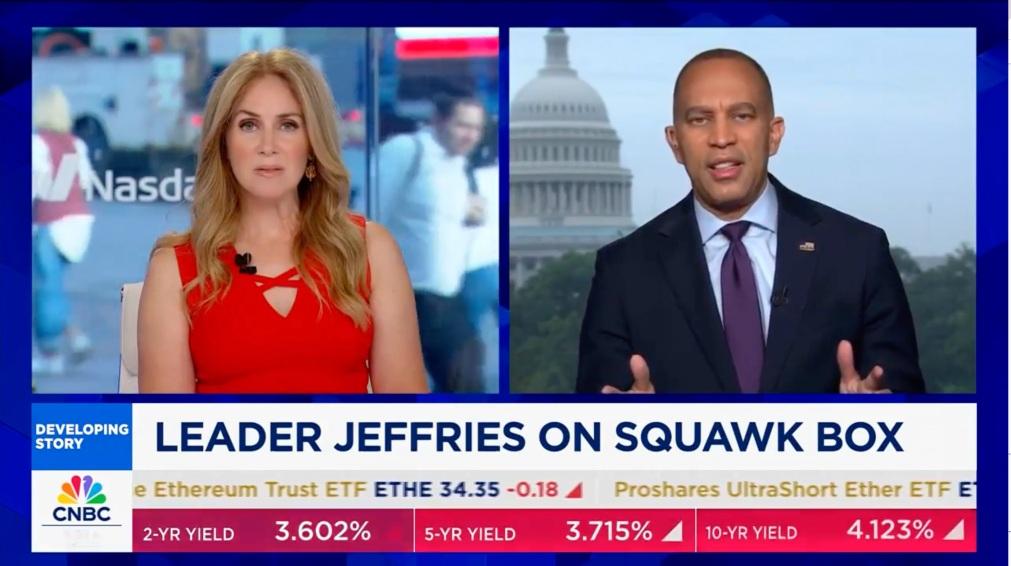

New York Leaders Rally to Extend Healthcare Tax Credits Amid Federal Funding Concerns

Facing the increasing possibility of a federal government shutdown, New York legislators, led by Representative Hakeem Jeffries, are intensifying their campaign to prolong healthcare tax credits. These credits have been instrumental in easing the financial burden of medical expenses for millions, particularly those enrolled in Affordable Care Act (ACA) plans. With healthcare costs climbing nationwide, the extension aims to maintain affordable coverage and prevent a surge in insurance premiums that could jeopardize access to essential medical services.

Key priorities outlined by Jeffries and his colleagues include:

- Swift legislative measures to avoid interruption of current healthcare subsidies.

- Broadening eligibility criteria to encompass more at-risk groups.

- Developing sustainable frameworks to ensure long-term healthcare affordability.

| Area of Impact | Current Situation | Benefits of Proposed Extension |

|---|---|---|

| Insurance Premiums | Increasing for many households | Stabilized through continued tax credits |

| Access to Coverage | Threatened for low-income individuals | Secured via expanded subsidies |

| Healthcare Providers | Experiencing delayed reimbursements | Improved payment schedules |

How a Government Shutdown Could Disrupt Healthcare Access in New York

The prospect of a federal shutdown raises serious concerns about the continuity of healthcare services, especially for vulnerable populations in New York. Programs like Medicaid and the Children’s Health Insurance Program (CHIP) depend heavily on federal funding, and any interruption could delay vital treatments and medication deliveries. Federally supported clinics may face operational setbacks, leading to longer wait times and fewer available appointments. Without the extension of healthcare tax credits, many low-income residents risk losing affordable insurance options, deepening existing health inequities.

Examining the potential fallout reveals critical areas of concern:

- Decline in Insurance Enrollment: The removal of tax credits could render premiums unaffordable for thousands.

- Disruptions in Preventive Care: Delays in essential screenings and immunizations may result in worsening health outcomes.

- Financial Pressure on Providers: Budget constraints could force clinics to reduce staff and limit services.

| Impact Category | Possible Outcome | Groups Most Affected |

|---|---|---|

| Affordability of Coverage | Premium hikes up to 30% | Low-income families, elderly |

| Healthcare Availability | Clinic closures and appointment delays | Rural and underserved urban populations |

| Preventive Health Services | Reduced access to vaccinations and screenings | Children and patients with chronic illnesses |

Strategies to Preserve Healthcare Tax Credits Amid Fiscal Challenges

To ensure continued healthcare affordability despite looming budgetary uncertainties, policymakers are advocating for a comprehensive approach focused on long-term financial planning and targeted reforms. This includes securing dedicated funding sources that shield tax credits from broader fiscal cuts and increasing transparency in how these credits are distributed. Experts recommend implementing adaptive mechanisms that adjust tax credit amounts in response to economic fluctuations, thereby guaranteeing consistent support for low- and middle-income households.

Moreover, enhanced cooperation between federal and state agencies is essential to streamline program administration and minimize bureaucratic hurdles. Emphasizing data-driven policy evaluations will help refine tax credit programs for maximum impact. The proposed policy framework encompasses:

- Inflation-Adjusted Tax Credits: To maintain purchasing power as healthcare costs rise.

- Automatic Renewal Clauses: Preventing sudden lapses during budget negotiations.

- Strengthened Oversight: To identify inefficiencies and prevent misuse of funds.

| Policy Component | Anticipated Advantage |

|---|---|

| Inflation-Indexed Credits | Preserve value against rising costs |

| Automatic Renewal | Ensure uninterrupted coverage |

| Federal-State Collaboration | Enhance program efficiency |

| Data-Driven Monitoring | Improve program effectiveness |

Bipartisan Appeal to Safeguard Healthcare Services from Disruption

Leading New York officials, with House Speaker Hakeem Jeffries at the forefront, are urging Congress to promptly extend healthcare tax credits critical to millions of Americans. The threat of a government shutdown has heightened concerns that essential health services could be interrupted, disproportionately affecting those who rely on these subsidies. Lawmakers stress that cross-party cooperation is vital to maintain steady access to affordable healthcare as federal budget discussions remain deadlocked.

In a recent joint declaration, legislators underscored several pressing issues:

- The potential elimination of subsidies, causing insurance premiums to spike.

- Funding uncertainties prompting healthcare providers to reduce services.

- Adverse effects on public health outcomes amid economic instability.

| Area of Concern | Expected Impact |

|---|---|

| Insurance Premiums | Projected increase up to 20% |

| Healthcare Accessibility | Decline in underserved areas |

| Provider Funding | Reduction in critical health programs |

Conclusion: The Urgency of Extending Healthcare Tax Credits

As the possibility of a federal government shutdown draws nearer, the concerted efforts by Representative Jeffries and New York lawmakers to extend healthcare tax credits highlight the critical need to protect affordable health coverage for millions. Their advocacy brings attention to the wider repercussions of political stalemates, underscoring the necessity for bipartisan collaboration to prevent interruptions in vital healthcare services during a time of economic uncertainty. The upcoming weeks will be pivotal in determining whether these legislative initiatives can secure relief before current funding expires.