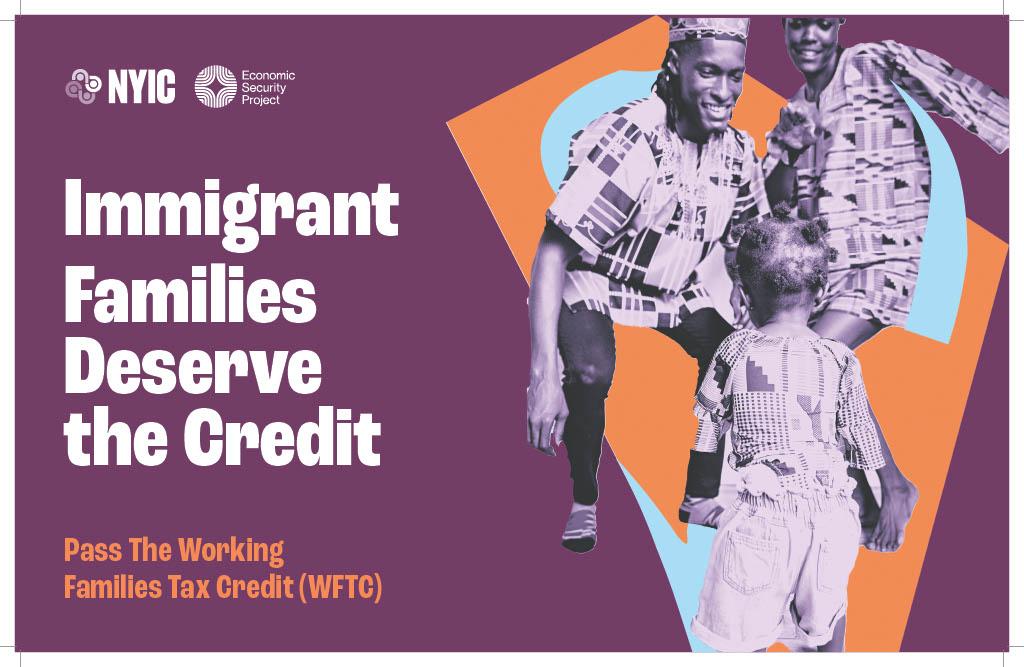

Empowering New York’s Workforce and Economy Through the Working Families Tax Credit

Stimulating Local Economies by Enhancing Household Earnings

New York’s economic landscape is at a crucial juncture as leaders seek strategies to uplift working families while nurturing business expansion. A prominent initiative under consideration is the Working Families Tax Credit (WFTC), a focused tax relief program aimed at increasing the disposable income of low- and moderate-income earners. Proponents highlight that this credit not only strengthens family finances but also invigorates local commerce by amplifying consumer expenditure and energizing economic momentum. This article delves into how the WFTC acts as a mutually beneficial mechanism for workers and New York’s dynamic business sectors.

By channeling additional funds directly to working households, the WFTC significantly boosts their purchasing capacity. Families typically allocate these resources toward vital expenses such as food, apparel, and utility bills, which in turn supports neighborhood retailers and service providers. This immediate surge in consumer spending helps stabilize small enterprises, particularly during periods of economic uncertainty, fostering a positive feedback loop of prosperity and community well-being throughout New York’s neighborhoods.

- Enhanced customer flow: Increased disposable income drives higher patronage of local shops and eateries.

- Employment growth: Rising sales empower businesses to expand their workforce, lowering joblessness.

- Community development: Thriving local economies encourage reinvestment in public amenities and infrastructure upgrades.

| Industry | Projected Spending Growth | Economic Impact |

|---|---|---|

| Retail | +$160M | Increased sales volume and job creation |

| Food Services | +$90M | Support for local restaurants and cafes |

| Utilities & Essential Services | +$65M | Steady revenue growth for providers |

How Rising Household Incomes Propel Business Expansion in New York

When families experience an uptick in income, the ripple effects extend far beyond individual households, invigorating New York’s broader economy. Increased disposable income translates into higher demand for a wide array of goods and services, benefiting retailers, hospitality venues, and service industries statewide. This surge in consumer activity encourages businesses to scale operations, hire additional employees, and invest in innovation, thereby cultivating a robust economic environment.

Moreover, elevated earnings stimulate growth in sectors such as housing and transportation, creating fertile ground for small and medium-sized enterprises to flourish. The following table outlines key industries that reap substantial advantages from increased household spending:

| Sector | Positive Effects of Income Growth |

|---|---|

| Retail | Boosted sales and foot traffic |

| Hospitality | Higher demand for dining and accommodation |

| Real Estate | Increased home buying and rental activity |

| Transportation | Greater utilization of transit services |

Strategic Enhancements to Amplify the Working Families Tax Credit

To fully harness the potential of the WFTC, policymakers should consider broadening eligibility parameters and raising the credit amounts. Expanding income limits would enable a larger segment of working families to benefit, injecting more spending power into local markets. Increasing the credit value would further incentivize consumer purchases, directly aiding small and medium businesses that depend on robust consumer demand. Complementary outreach efforts are essential to ensure that eligible families are well-informed and able to access the program efficiently.

- Widen income eligibility to encompass more working households

- Boost credit amounts to strengthen purchasing incentives

- Launch targeted outreach campaigns to increase awareness and enrollment

- Simplify application procedures for faster benefit delivery

Furthermore, fostering partnerships between government agencies and local business groups can create comprehensive support networks for participating enterprises. Integrating tax credit benefits with business development initiatives and workforce training programs will cultivate a sustainable environment for economic advancement. Establishing robust monitoring systems will enable continuous evaluation of the program’s impact on employment and revenue, allowing for data-driven policy refinements. Below is a summary of recommended strategies and their anticipated outcomes:

| Policy Initiative | Projected Result |

|---|---|

| Increase Credit Value | Elevated consumer spending and sales growth |

| Expand Eligibility | Broader family participation and economic impact |

| Outreach Programs | Higher program enrollment and awareness |

| Business Collaboration | Stronger support systems and growth opportunities |

| Impact Evaluation | Informed policy adjustments and improved outcomes |

Cross-Sector Collaboration: A Key to Unlocking the WFTC’s Full Potential

Maximizing the effectiveness of the Working Families Tax Credit requires coordinated efforts among government bodies, private enterprises, and community organizations. Such partnerships enhance outreach to eligible families, streamline benefit access, and ensure the credit translates into substantial economic support. Employers are instrumental in educating their workforce about the credit and facilitating enrollment through payroll systems, while nonprofits provide vital assistance tailored to diverse populations.

Collaboration also enables data sharing and impact assessment, which are critical for refining the program and amplifying its benefits. For instance, joint efforts among local businesses, government agencies, and advocacy groups can pinpoint communities and sectors where families face the greatest financial challenges, allowing the WFTC to serve as a catalyst for economic revitalization. The table below summarizes the roles and contributions of various stakeholders:

| Stakeholder | Contribution to WFTC Success | Resulting Benefit |

|---|---|---|

| Government | Policy formulation, funding allocation, data analytics | Efficient program management and targeted outreach |

| Businesses | Employee engagement, payroll integration | Increased participation and improved employee satisfaction |

| Community Groups | Direct outreach, application support | Enhanced accessibility and community trust |

Final Thoughts

The Working Families Tax Credit represents a powerful tool for stimulating New York’s economy by elevating consumer spending and reinforcing local business ecosystems. As the state continues its path toward recovery and growth, policies that empower working families not only improve financial stability but also cultivate a thriving marketplace that benefits employers and communities alike. Ongoing commitment to expanding and refining such initiatives will be vital in building a resilient, inclusive economic future for New York.