In change for a profitable 40-year tax abatement, the brand new house owners of an Higher East Aspect condominium constructing are promising one thing practically exceptional: a primary Manhattan residential property that might be one hundred pc inexpensive.

However some long-time tenants of the constructing at the moment are questioning the developer’s math – declaring many residences on the property have been already topic to New York’s Hire Stabilization program earlier than the brand new proprietor took over. In addition they say any new earnings restrictions might not kick in for years.

“In totality, they’re not really adding many units,” mentioned Luigi Racanelli, a tenant of 170 East 83rd Avenue who spoke up at a current assembly of Manhattan Neighborhood Board 8.

Again in October, Douglaston Growth, the purchaser of property on the nook of East 83rd Avenue and Third Avenue, instructed Neighborhood Board members concerning the plan to position earnings restrictions on all 50 models within the constructing.

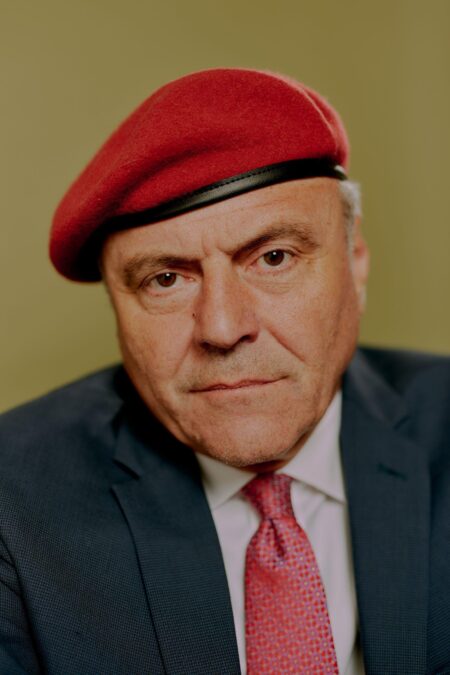

“We’re going to commit to providing permanently affordable housing for 100 percent of the units within this building,” mentioned Daniel Russo, Douglaston’s challenge supervisor.

“It would do nothing but benefit the neighborhood by creating 50 units of affordable housing,” added Steven Charno, President of Douglaston Growth.

However in keeping with the final decade’s value of tax data printed by the NYC Division of Finance, the property already had between 38 and 41 residences protected below New York’s Hire Stabilization program. Hire Stabilization is a authorized classification that ends in a number of the lowest rents in all of New York Metropolis.

Oksana Mironova, a coverage analyst at Neighborhood Service Society, a nonprofit that advocates for inexpensive housing, mentioned a property with plenty of present hire protections might not justify a tax break that may very well be value tens of thousands and thousands of {dollars} over 4 many years.

“If the building was just left alone, the Rent Stabilized units would still be affordable with the city not putting anything in,” Miranova mentioned.

Siobhan Shares-Lyons, a spokesperson for Douglaston, mentioned the developer doesn’t know the place the Division of Finance obtained its depend of beforehand Hire Stabilized models, however insisted the entire residences within the constructing would acquire new affordability protections within the proposed deal.

“All units will immediately become subject to rent stabilization,” she wrote. “Income restrictions will apply to all units upon turnover. So that is a net increase of 50 units permanently subject to income restriction.”

Douglaston Growth has declined to supply its personal accounting of what number of residences within the constructing loved Hire Stabilization protections earlier than and after its buy of the property.

Likewise, the New York State Division of Housing and Neighborhood Renewal (DHCR), which administers the state’s Hire Stabilization program, declined to share what number of models within the constructing are at present protected by hire laws. DHCR says these numbers are protected by privateness guidelines.

Along with preserving residences that already take pleasure in hire protections, Douglaston Growth can also be promising to freeze the present rents in market-rate models. When these market-rate tenants transfer out – the proprietor would place new earnings restrictions on these residences as effectively, making them out there to NYC renters through a lottery. Based on current rental listings, one of many market-rate 1-bedroom residences within the constructing was marketed at round $6,500 per 30 days. One of many market-rate 3-bedroom residences was marketed at about $8,500 per 30 days.

Greg Harden, a tenant who at present occupies a Hire Stabilized unit within the constructing, mentioned he believes his market-rate neighbors are more likely to hold re-signing their leases below the deal as a result of they’ll know doing so would shield them from larger housing prices . If that occurred, he mentioned, right now’s dear rents can be preserved and future affordability provisions for market-rate models can be postponed.

“Very few of these apartments are likely to be available or turned over in the coming years,” Harden mentioned which makes one ponder whether our taxes can be higher used gathering actual property taxes on the constructing after which utilizing these funds to distribute vouchers to needy households and renters?”

The tax break sought by Douglaston known as an Article 11 abatement which might exempt a landlord from as much as one hundred pc of its metropolis property tax invoice for 4 many years. Multiplying the constructing’s present annual tax invoice by 40 years would quantity to greater than $26 million {dollars}.

New York Metropolis’s Division of Housing Preservation and Growth should comply with the deal if the abatement is to be authorised.

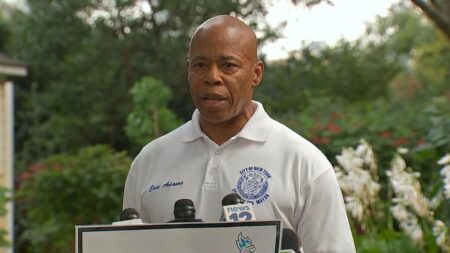

Ilana Maier, an HPD spokesperson, mentioned the Adams administration is at present evaluating the specifics of the challenge “with a goal to protect, preserve and improve affordability.”

She added, “The only thing set in stone, as with all preservation opportunities is that we will do everything in our power to keep tenants safe in affordable homes.”

If the Adams administration have been to approve the tax break it might then go up for a Metropolis Council vote.

Council Member Keith Powers (D – Higher East Aspect), who represents the neighborhood the place the challenge is deliberate, declined to say whether or not he helps the tax break or opposes it.

“While this project is potentially beneficial to tackling the housing crisis, it is crucial that existing tenants are protected, well-informed, and receive the benefits of the final plan for the building,” Powers mentioned. “My workplace will proceed to work with all events to make sure that this works for everybody concerned.”

In tandem with its request for a property tax abatement on the inexpensive constructing, Douglaston additionally disclosed it’s planning to construct a luxurious residential tower subsequent door. When the developer bought 170 E 83rd Avenue, the constructing existed as a 90-unit rental property that spanned a complete metropolis block. Douglaston says the prior proprietor delivered the constructing with residences vacant on the south aspect of the block. The vacant southern portion of the constructing has since been demolished – paving the way in which for development of the posh condominium constructing.

Mironova believes pairing the inexpensive housing challenge with a brand new luxurious tower might truly work towards the aim of extra inexpensive rents, as a result of sq. footage within the new constructing is more likely to command high greenback.

“If you take this kind of deal and multiply it in a fictitious city, it would increase the rents,” she mentioned. “I do not think it’s a good deal for the city.”