Preserving Healthcare Benefits for New York City Retirees: A Vital Commitment Amid Fiscal Challenges

Why Honoring Healthcare Guarantees for NYC Retirees Matters

For many decades, retired public employees in New York City have depended on the healthcare benefits assured to them as part of their retirement compensation. These benefits are far more than mere incentives; they serve as critical protections that enable retirees to obtain necessary medical care without facing financial hardship. In today’s climate of escalating healthcare expenses and economic unpredictability, it is imperative to uphold these promises to safeguard a population that has devoted their lives to the city’s service.

The consequences of reneging on these commitments include:

- Higher personal healthcare costs for retirees

- Damage to the trust between former public employees and city leadership

- Worsening health conditions that increase strain on emergency healthcare systems

City leaders must ensure that healthcare policies remain transparent and consistent, reflecting respect and accountability toward retirees. The table below highlights the rising healthcare expenses faced by NYC retirees, emphasizing the urgent need to protect these benefits.

| Year | Annual Healthcare Cost Increase (%) | Growth in Retiree Out-of-Pocket Expenses (%) |

|---|---|---|

| 2019 | 5.2% | 4.1% |

| 2020 | 6.0% | 5.5% |

| 2021 | 7.1% | 6.3% |

| 2022 | 7.8% | 7.0% |

Fiscal Obstacles Impacting Retiree Healthcare Funding

The financial landscape for funding retiree healthcare is increasingly strained due to budgetary limitations, inflationary pressures, and a growing elderly population. Policymakers are challenged to balance these fiscal constraints while honoring binding commitments to retirees. Public pension funds, already vulnerable to market volatility, now face the added challenge of covering surging healthcare costs without sufficient new income sources. This predicament forces tough decisions between sustaining retiree benefits and funding other critical municipal services.

Several factors intensify these funding difficulties:

- Longer life spans, extending the duration of healthcare coverage

- Medical cost inflation outpacing general inflation rates

- Declining or stagnant tax revenues limiting city budgets

- Contractual restrictions limiting adjustments to healthcare benefits

| Year | Estimated Healthcare Cost per Retiree | Funding Shortfall (in $ millions) |

|---|---|---|

| 2023 | $15,200 | 850 |

| 2025 | $17,800 | 1,120 |

| 2030 | $22,500 | 1,560 |

Repercussions of Failing to Honor Healthcare Agreements

Neglecting to fulfill healthcare commitments to retirees can lead to a series of detrimental effects that extend beyond immediate financial burdens. Retirees relying on these benefits may face increased personal expenses and delays in receiving essential medical care. This is especially critical for elderly individuals managing chronic illnesses who depend heavily on these guarantees to maintain their health and independence. Furthermore, breaking these promises risks eroding public trust in government institutions, potentially leading to social and political unrest.

Financially, the city could experience increased demands on emergency healthcare and social support systems, creating a cycle of escalating costs and instability. Key risks include:

- Rising Medical Debt: Retirees may accumulate unmanageable healthcare bills, threatening their financial security.

- Greater Reliance on Public Aid: Limited access to preventive care could increase dependence on emergency services and welfare programs.

- Legal Exposure: Breach of contract may result in costly lawsuits, further straining municipal resources.

| Impact | Description |

|---|---|

| Financial Strain | Increased healthcare expenses for retirees |

| Health Deterioration | Delayed treatments leading to worsening conditions |

| Legal Risks | Potential lawsuits and financial penalties |

| Loss of Trust | Decline in confidence toward public institutions |

Strategies to Ensure Sustainable Retiree Healthcare Benefits

To secure the future of healthcare benefits for New York City’s retired public employees, it is essential to implement policies that promote financial resilience and equitable access. This involves a multifaceted approach combining fiscal prudence with innovative health management. Enhancing transparency in fund management and strengthening oversight mechanisms can reduce risks of misallocation and build public confidence. Additionally, investing in preventive healthcare tailored to seniors can lower emergency care costs and preserve resources for comprehensive coverage.

Recommended actions include:

- Creation of a dedicated healthcare trust fund with secured and protected funding sources.

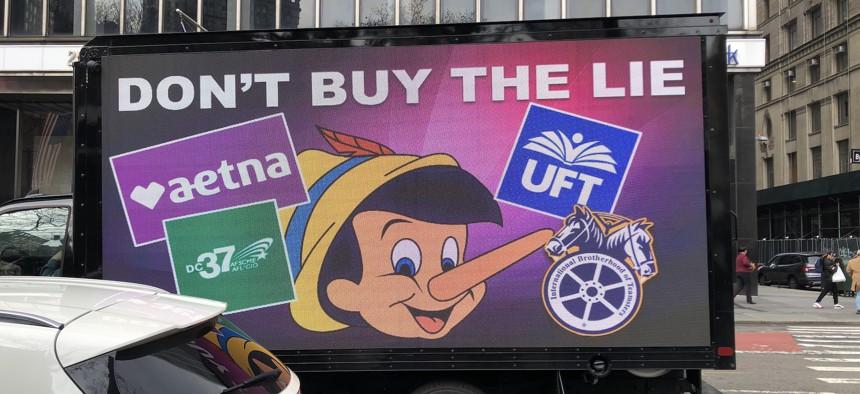

- Partnerships with private insurers to explore cost-sharing and risk mitigation models.

- Regular actuarial assessments to adjust funding contributions based on demographic and economic trends.

- Adoption of digital health technologies to enhance service delivery and reduce administrative expenses.

| Initiative | Anticipated Benefit | Implementation Timeline |

|---|---|---|

| Dedicated Trust Fund | Ensures stable funding for retiree healthcare | 1-3 years |

| Public-Private Collaborations | Lower costs through shared financial risk | 2-4 years |

| Actuarial Reviews | Funding aligned with changing demographics | Annual |

| Digital Health Solutions | Improved access and reduced administrative costs | 3-5 years |

Conclusion: Upholding Our Commitment to NYC’s Retired Public Servants

In a city as vibrant and multifaceted as New York, the health and dignity of retired public employees reflect our shared values and priorities. As discussions about the future of retiree healthcare benefits continue, one principle must remain unwavering: the promises made to those who have devoted their careers to public service must be honored. Protecting these benefits is essential not only to maintain trust but also to ensure the security and well-being of thousands of retirees. Moving forward demands thoughtful engagement, fiscal discipline, and an unwavering dedication to fulfilling the social contract that binds the city and its public servants.