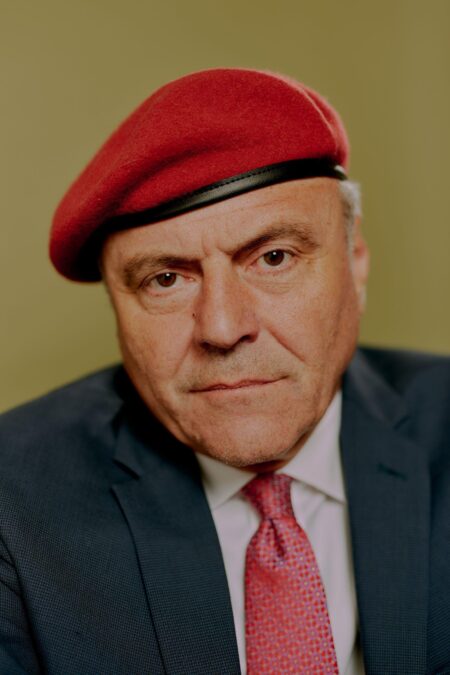

A prominent New Jersey real estate investor and social media influencer has been charged in connection with a sprawling multi-million-dollar fraud scheme, authorities announced Wednesday. The individual, known for leveraging their online platform to promote investment opportunities, now faces serious allegations that could carry significant legal consequences. This development has sent shockwaves through the local real estate community, raising questions about oversight and transparency in the growing world of property investment influencers.

NJ Real Estate Investor Faces Federal Charges in Massive Fraud Case

A prominent real estate investor from New Jersey, who also cultivated a significant following as a social media influencer, has been formally charged with orchestrating a fraudulent scheme that allegedly defrauded investors out of millions of dollars. Federal prosecutors detail a pattern of deceptive practices, including falsifying property values and misrepresenting investment returns to secure funds. The accused reportedly exploited their online presence to entice unsuspecting investors, blurring the line between legitimate real estate ventures and a multi-million-dollar swindle.

Key elements of the case include:

- Misleading financial statements presented during investment pitches

- Complex web of shell companies used to hide illicit transactions

- Manipulation of real estate contracts to inflate asset worth

Authorities warn that the investigation is ongoing, and further details could lead to additional charges as more victims come forward. Below is a summary of the alleged financial impact based on initial findings:

| Aspect | Estimated Loss |

|---|---|

| Investor Funds Raised | $15 million |

| Recovered Assets | $3 million |

| Outstanding Investor Claims | $12 million |

Inside the Alleged Multi-Million-Dollar Scheme Targeting Homebuyers and Investors

Authorities have unveiled a complex operation that allegedly duped homebuyers and investors across New Jersey in a scheme estimated to be worth millions. The accused, a prominent real estate investor and social media influencer, reportedly exploited his wide online following to fraudulently promote investment opportunities in upscale properties. The investigation revealed key tactics employed by the scheme:

- Manipulating sales documents to inflate property values.

- Fabricating rental income reports to lure investors.

- Pressuring buyers into quick decisions with false scarcity claims.

The scope of the alleged fraud has prompted a deeper look at how influencer-driven endorsements can distort real estate markets. Below is a summary of the financial impact reported so far:

| Category | Approximate Loss |

|---|---|

| Investors Defrauded | $8 million |

| Homebuyers Affected | $4.5 million |

| Properties Involved | 35 |

Impact on the New Jersey Real Estate Market and Investor Community

The recent charges against a prominent New Jersey real estate investor, whose influence permeated both social media and the local property market, have sent ripples through the community. Investors and homeowners alike are now viewing transactions with heightened scrutiny, wary of potential pitfalls in an increasingly complex market landscape. This high-profile case has highlighted the vulnerabilities in oversight and the crucial need for transparency among market participants.

Industry experts warn that the fallout could lead to stricter regulatory measures, impacting the pace and nature of property deals across the state. Key effects observed in the immediate aftermath include:

- Investor caution: Many are reevaluating partnerships and investment opportunities.

- Market slowdown: Some listings remain stagnant as buyers hesitate.

- Due diligence intensifies: Enhanced background checks and financial reviews.

| Market Indicator | Before Charges | After Charges |

|---|---|---|

| Average Time on Market | 30 days | 45 days |

| Investor Confidence Index | 78% | 52% |

| New Listings per Month | 220 | 190 |

Legal Experts Recommend Caution and Due Diligence for Prospective Real Estate Investors

Legal professionals are urging prospective real estate investors to exercise heightened vigilance in the wake of recent revelations involving a New Jersey investor and influencer, who has been charged with orchestrating a multi-million-dollar fraudulent scheme. The case underscores the necessity for thorough background checks and a critical assessment of claims made by industry voices, especially those with significant social media followings. Experts emphasize that endorsements or flashy marketing presentations do not guarantee the legitimacy of ventures or individuals.

Key precautions recommended by legal experts include:

- Conducting independent verification of investment opportunities

- Consulting with qualified real estate attorneys before committing funds

- Reviewing all contractual documents carefully for red flags or ambiguous terms

- Monitoring regulatory filings and enforcement actions related to the investor or project

| Due Diligence Step | Purpose |

|---|---|

| Background Check | Verify credibility of investors and influencers |

| Legal Review | Identify potential risks in contracts |

| Regulatory Search | Confirm absence of enforcement actions |

| Financial Analysis | Assess viability of investment returns |

Key Takeaways

As this high-profile case unfolds, it serves as a stark reminder of the risks and complexities inherent in the real estate investment sector. Authorities continue to investigate the full scope of the alleged multi-million-dollar scheme, emphasizing the importance of transparency and due diligence for both investors and industry professionals. The outcome of the charges against the New Jersey real estate investor and influencer will undoubtedly have significant repercussions across the market, highlighting the ongoing need for vigilant regulatory oversight in an increasingly scrutinized industry.