New York City’s Fiscal Fortitude Amid Federal Funding Cuts and Trade Tariffs

Robust Financial Planning Shields NYC from Tariff-Induced Economic Strains

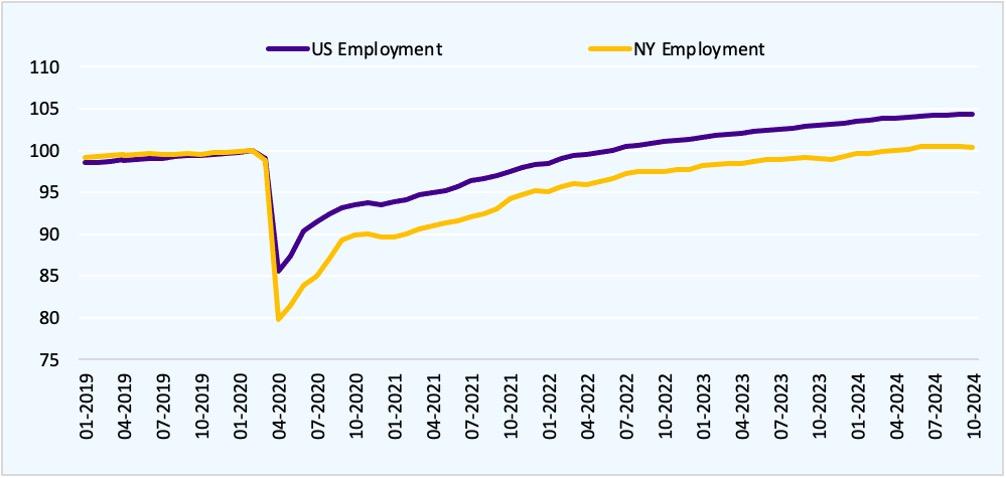

Despite growing apprehensions about the economic fallout from tariffs enacted during the Trump administration and impending reductions in federal funding, New York City’s financial leadership remains steadfast. The Adams administration underscores the city’s strong fiscal framework, which is buttressed by diversified income sources and prudent budget management. Investments in local enterprises and infrastructure projects continue to fuel economic vitality and preserve employment opportunities, serving as critical buffers against external economic shocks.

To counterbalance these challenges, city officials have implemented several targeted initiatives, including:

- Dedicated support for small and medium-sized businesses to encourage innovation and sustainable growth

- Establishment of contingency funds and strategic reserves to manage unexpected budgetary shortfalls

- Strengthened collaborations with private and nonprofit organizations to diversify revenue streams and reduce dependency on federal assistance

| Fiscal Metric | 2023 Projection | Tariff Impact |

|---|---|---|

| Sales Tax Revenue | $17.5 Billion | Remains Stable |

| Federal Funding | $12.3 Billion | Decreased by 4% |

| Budget Reserve | $3.2 Billion | No Change |

Mayor Adams Refutes Pessimistic Economic Predictions

Contrary to alarming forecasts suggesting a severe economic downturn for New York City due to tariff pressures and federal budget cuts, the Adams administration remains confident in the city’s economic stability. Officials highlight the city’s broad-based revenue generation and sound fiscal policies as key factors that mitigate these external risks. While acknowledging the challenges posed by federal policy shifts, city leaders assert that these do not pose an immediate threat to New York’s economic health.

Critical factors reinforcing the city’s economic resilience include:

- Consistent growth in tax revenues fueled by robust real estate and retail sectors

- Diverse and expanding employment landscape spanning technology, healthcare, and financial services

- Substantial municipal reserves designed to absorb fiscal shocks

| Category | Estimated Impact | Available Buffer | Net Position |

|---|---|---|---|

| Federal Funding Reductions | -$200 Million | $1 Billion | +$800 Million |

| Tariff-Related Business Losses | -$150 Million | $900 Million | +$750 Million |

| Total Fiscal Impact | -$350 Million | $1.9 Billion | +$1.55 Billion |

Innovative Fiscal Strategies to Counteract Federal Budget Reductions

In response to anticipated cuts in federal funding, New York City’s administration has crafted a comprehensive plan to preserve fiscal stability while maintaining uninterrupted public services. This approach centers on broadening revenue sources and enhancing operational efficiency. Key tactics include bolstering tax compliance, fostering public-private collaborations, and pursuing alternative funding avenues such as state grants and philanthropic contributions.

Highlighted initiatives encompass:

- Reprioritizing capital expenditures to focus on critical infrastructure and social welfare programs

- Implementing technology-driven process improvements to streamline municipal operations and reduce costs

- Seeking new funding opportunities beyond federal sources, including state-level and private grants

| Funding Source | Projected Outcome | Expected Timeline |

|---|---|---|

| Enhanced local tax enforcement | Moderate revenue growth | 6 to 12 months |

| Public-private investment partnerships | Sustained capital inflows | Ongoing |

| State and philanthropic grant programs | Targeted funding for key initiatives | 12 to 18 months |

Strategies to Foster Economic Stability and Long-Term Growth

City leaders advocate for a multi-faceted approach to fortify New York’s economy against unpredictable federal policy shifts. Central to this vision is the expansion of diverse revenue channels, nurturing innovation in emerging sectors such as clean energy and technology, and reinforcing partnerships with local enterprises. Maintaining fiscal discipline by prioritizing essential services and infrastructure development remains a cornerstone of the city’s economic strategy.

Key initiatives underway include:

- Scaling up support programs for small businesses to stimulate employment

- Utilizing public-private collaborations to modernize urban infrastructure

- Investing in workforce training to align with evolving industry demands

| Initiative | Focus Area | Immediate Benefit |

|---|---|---|

| Revenue Diversification | Fiscal Stability | Lowered Financial Risk |

| Business Development Support | Employment Growth | Increased Job Opportunities |

| Infrastructure Investment | Urban Renewal | Upgraded Public Facilities |

Conclusion: Navigating Economic Challenges with Confidence

As New York City confronts the uncertainties posed by federal funding reductions and trade-related tariffs, the Adams administration remains cautiously optimistic. While some analysts predict economic hardships, city officials emphasize their commitment to resilience, strategic fiscal management, and sustainable growth. Through proactive measures and diversified financial strategies, New York City aims to withstand these pressures and continue thriving. The upcoming months will be pivotal in evaluating the real-world effects of these federal policies on the city’s economic trajectory.