It is tax season once more in america and as residents file for the 2024 tax yr, one of many questions most frequently requested is “Where is my refund?”

The IRS not too long ago introduced Jan. 27 because the official begin date of the 2025 tax season, and expects greater than 140 million tax returns to be filed by the April 15 tax deadline.

The announcement comes with company within the midst of an enormous overhaul, making an attempt to enhance its know-how and customer support processes with tens of billions of {dollars} allotted to the company by Democrats’ Inflation Discount Act, signed into legislation in August 2022.

The IRS stated it’s increasing its program that permits folks to file their taxes straight with the company free of charge. The federal tax collector’s Direct File program, which permits taxpayers to calculate and submit their returns to the federal government straight with out utilizing business tax preparation software program, will probably be out there to taxpayers in 25 states beginning Jan. 27, up from 12 states that had been a part of final yr’s pilot program.

The pilot program in 2024 allowed folks in sure states with quite simple W-2s to calculate and submit their returns on to the IRS. These utilizing this system claimed greater than $90 million in refunds, the IRS stated in October.

How lengthy will it take to get my refund?

The IRS expects most refunds to be issued in lower than 21 days.

The place’s My Refund IRS instrument

The company says taxpayers can use The place’s My Refund? to examine the standing of their 2024 earnings tax refund inside 24 hours of e-filing. Refund info is generally out there after 4 weeks for taxpayers who filed a paper return.

“If you e-file your return, you can usually see your refund status after about 48 hours with Where’s My Refund? You can get your refund information for the current year and past 2 years,” the IRS stated.

The company additionally stated it expects to take care of ranges of service achieved previously, together with wait occasions of lower than 5 minutes for help.

“Wait times are longer on Mondays and Tuesdays, during Presidents Day weekend and around the April tax filing deadline,” the IRS web site says.

IRS contact info for tax assist

The IRS has numerous instruments and assets out there for assist right here.

People can name the IRS at 800-829-1040 from 7 a.m. to 7 p.m. native time for help whereas enterprise can name 800-829-4933 throughout that very same time window.

The IRS stated wait occasions are longer Mondays and Tuesdays.

Two targets for the upcoming tax submitting season are to supply 10,000 prolonged workplace hours and to increase the IRS rural outreach program by 20%, growing the variety of returns ready. The company stated it additionally continues to simplify notifications to make language less complicated to know.

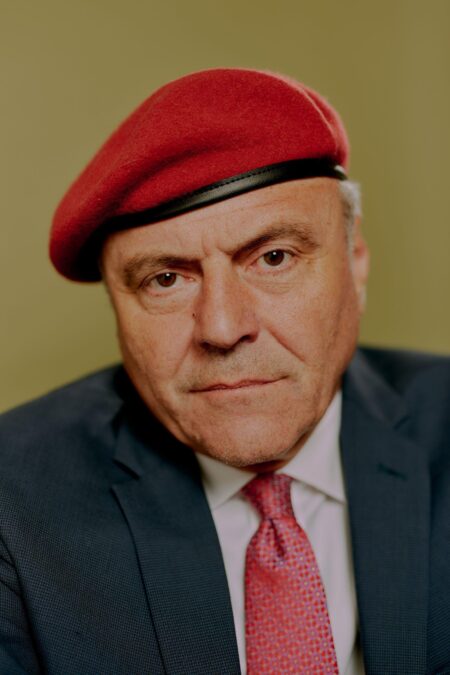

IRS Commissioner Daniel Werfel additionally stated the IRS is working to enhance public consciousness of the Earned Earnings Tax Credit score, stating that just about 1 in 5 eligible taxpayers don’t declare it as a result of they don’t learn about it or understand they qualify.

As in previous years, the IRS additionally urges filers to protect towards tax scams, stating that unhealthy actors proliferate throughout submitting season, making false guarantees of tax assist or faux threats to get folks to pay penalties they don’t owe. Filers can go to IRS.gov and search “scams” for the newest info.

Multiyear supplemental funding offered by Congress permits the IRS to take care of its present staffing ranges, the commissioner stated on the decision, including that the IRS’s know-how and instruments will stagnate if the funding is eradicated.

“This has been a historic period of improvement for the IRS,” Commissioner Werfel stated. “More can be done with continued investment in the nation’s tax system.”

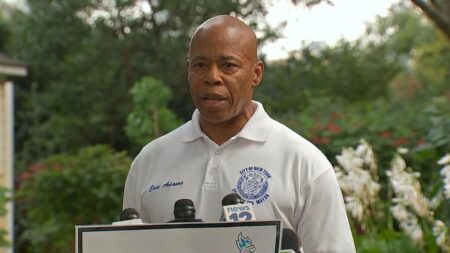

We’re in the course of tax season – and with it many individuals could really feel overwhelmed in submitting correct tax returns, nevertheless it’s necessary to notice that there’s loads of misinformation on the market in regards to the subject. Alejandra Castro, spokesperson for the IRS, speaks with NBC New York about widespread tax myths and the details.

When are my taxes due?

The tax submitting deadline is April 15, 2025 for the 2024 tax yr, however you probably have any questions, you must examine with the IRS or a tax skilled.