Congress final raised the debt ceiling in June 2023, after the U.S. hit the ceiling on Jan. 18 of that 12 months. The prolonged battle didn’t finish in a default on the nationwide debt, however as an alternative that vote to boost and droop the ceiling by means of Jan. 1, 2025.

Between that Jan. 1 debt ceiling reinstatement and the opportunity of a authorities shutdown with no stopgap funding invoice, the incoming Trump administration may face severe issues on day one.

“It doesn’t mean anything, except psychologically,” he stated.

This is a primer on the nationwide debt, what occurs if we default and why it is unhealthy.

What’s the nationwide debt restrict?

The nationwide debt ceiling, or debt restrict, is basically a cap, determined by lawmakers, on how a lot debt the U.S. authorities can have.

On Jan. 18, 2023, the final time we reached that restrict, it sat at a whopping $31.4 trillion {dollars}.

As a result of Congress voted in June to droop the ceiling, when the debt restrict is reinstated on Jan. 1, 2025, the brand new quantity might be based mostly on the U.S.’s present debt at the moment.

When Congress passes a spending invoice, they resolve what the federal government will spend its income on. That income comes largely from taxes, but additionally from issues like customs duties on the border and the sale of pure assets, in accordance with the U.S. Treasury’s Fiscal Knowledge web site.

More often than not, the federal government would not have sufficient income available to pay for the whole lot in these spending payments — resembling infrastructure, social safety, Medicare and protection. That is been the case since at the least 2001, which was the final time the Treasury says extra money was introduced in than spent in a single 12 months.

The hole between the income, and the issues the federal government is spending it on, is the nationwide deficit.

“We’re spending more money, over a trillion dollars this year, than we’re taking in,” defined Greg Valliere, the Chief U.S. Coverage Strategist for AGF Investments. “That gives us the deficit.”

To make up the deficit and repay money owed, the Treasury sells securities, like bonds. The bond purchaser provides the Treasury money to pay the deficit, and in change the Treasury finally pays the client again that cash plus curiosity.

The debt restrict caps how a lot debt the Treasury can tackle to pay again the deficit incurred in earlier years. As of Jan. 18, the Treasury took on the utmost $31.4 trillion in debt allowed — that means we would hit the debt restrict.

The debt restrict quantity is determined by Congress.

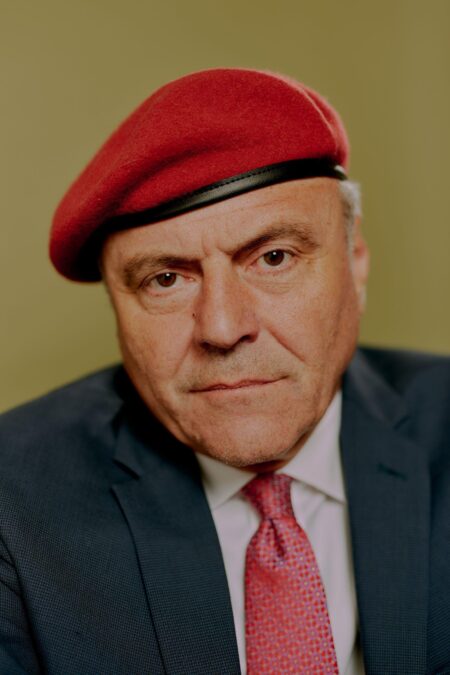

“The debt limit is a political issue, that both parties have used to their advantage, that requires Congress to raise the amount of debt we can have,” Valliere stated.

What occurs once we hit the debt restrict?

Hitting the debt restrict is not catastrophic. Based on U.S. Treasury Secretary Janet Yellen, the U.S. had already reached that ceiling as of Jan. 18. 2023.

“I don’t think today’s number means anything,” Valliere stated. “I think it’s more of a summer crisis.”

Hitting the debt restrict is like beginning the ultimate countdown clock for the federal government earlier than the actual catastrophe — a default — strikes. As soon as the clock begins ticking, the U.S. must both enhance the quantity of debt it will probably tackle, or droop the restrict to that debt earlier than it runs out of cash.

Yellen stated in a Could 2023 letter to Congress that the cash may run out by June 1 of that 12 months. Congress voted to droop the debt restrict simply days earlier than that deadline, on June 3.

“After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time,” the letter learn partially, warning that a precise date is difficult to estimate with “variable” situations.

On Could 26, Yellen as soon as once more revised her estimate based mostly on the newest obtainable information, and set the deadline again to June 5.

The entire $31.4 trillion — or extra, when the restrict is reinstated in January — included below the present debt restrict is cash the federal government has already spent on issues like infrastructure, protection and so forth.

As soon as the debt restrict is reached, the Treasury cannot promote any extra bonds and different securities to repay the debt from earlier deficits. Put merely: it will probably’t get money to repay payments the federal government has already accrued.

If the U.S. cannot pay these payments, then it defaults on the nationwide debt. That is the place disaster strikes.

Economists say penalties of a default on the nationwide debt may embody larger rates of interest, a inventory market crash, a recession and big job losses. NBC’s Alice Barr studies.

Why is defaulting unhealthy?

“[It’s] in my opinion unthinkable to have the U.S. say ‘We can’t pay off our debt,'” Valliere stated.

The Treasury would cease with the ability to pay out the federal cash that goes to issues like “Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds and other payments,” in accordance with a warning letter Yellen despatched to Congress final week.

It will additionally cease the Treasury from paying again the cash and curiosity that each one these bond holders have been promised once they made these purchases.

“I think it would be a signal to investors all around the world, including in the U.S… that the U.S. debt can’t be counted on,” Valliere stated.

The U.S. credit standing “would almost certainly be downgraded,” the White Home stated in a December 2021 publish concerning the results of a default, “and interest rates would broadly rise for many consumer loans, making products like auto loans and mortgages more expensive for families who are subject to interest rate changes or taking out new loans.”

Larger rates of interest because of downgraded U.S. credit score would make it even more durable for the Treasury to pay again the curiosity on future debt.

“In order to sell our debt, we’re probably going to have to sell it at higher rates,” Valliere stated. “You’d have to offer higher rates to induce people to keep buying treasuries, because their risk will go up.”

That will have a unfavourable impact on the inventory market. And with religion within the U.S. greenback tied to so many different items of the worldwide market, these unfavourable results can be felt worldwide.

Why did we hit the debt restrict final January?

Congress set the newest $31.4 trillion debt restrict again in December 2021, when Democratic majorities in each the Home and the Senate voted to boost the debt restrict by $2.5 trillion.

That vote got here after one other near-crisis after drawn out debate over spending, which ended simply hours shy of the deadline set by Yellen.

“What’s different this time I think is that you have an awful lot of very hardcore Republicans in the House, as we saw a couple of weeks ago,” Valliere stated final January, referring to the 15 votes that happened earlier than former Home Speaker Kevin McCarthy bought the gavel.

“And they are unwilling to agree to any increase in the debt ceiling unless there’s an ironclad pledge to reduce spending.”

The rationale the talk over elevating the debt restrict is so arduous is as a result of there is not any perfect place for the federal government to tighten its belt and shut the deficit to cut back that debt, Valliere defined.

“The problem is, people agree generally that we’re spending too much money and deficits aren’t good,” stated Valliere. “But when you get specific and you say, alright, so what would you do? Would you cut social security? Well, no, my God. Would you cut Medicare? No. Would you cut defense? Well, not dramatically… Would you have a big tax increase? No.”

With out tax will increase to residents or companies, cuts or curtails to authorities spending or a mixture of each, the nationwide debt will proceed to rise to a brand new restrict set by Congress. Then this cycle repeats.

Does the debt restrict cease U.S. authorities spending?

If the debt restrict stayed the place it was in January 2023, the U.S. would nonetheless have $31.4 trillion of debt to pay, as a result of that cash has already been spent and must be paid again.

The quantity the federal government continues to spend on issues it wants, like infrastructure, protection, and social safety, is simply decided by future spending offers. The persevering with decision that Congress is at present debating earlier than the Dec. 20 shutdown deadline is one such future spending deal — and it’s a associated, however totally different, political debate.

Theoretically, the debt restrict is a instrument to maintain authorities spending from increasing unchecked.

If there is a ceiling on how a lot debt the U.S. Treasury can tackle by issuing securities, then the federal government cannot hold widening the deficit when it decides how a lot to spend.

However enhance income — the sum of money the federal government is bringing in — is the place Republicans and Democrats are likely to disagree. Very typically, Republicans want to chop spending whereas Democrats discover methods to boost extra money by means of taxes.

The message from a Virginia Democrat and a Pennsylvania Republican is easy: in case you do not do your job, you aren’t getting paid.

Even when Congress authorizes a rise to the debt restrict, the political negotiations required to get there can generally result in some type of budgeting compromise between the 2 very opposed events.

Based on Valliere in January, that logic nonetheless holds some weight.

“Previous deals have usually been accompanied by some fiscal restraint,” he stated. “As painful as this exercise will be, I think it almost certainly will [result] in less spending… Or, to be accurate in the phraseology, it’s not like we’re going to cut defense. We’re going to slow the rate of increase.”